Aquilius Investment Partners was founded in 2021 by Bastian Wolff and Christian Keiber with a mission to unlock institutional-grade liquidity across Asia Pacific’s private markets through innovative and flexible secondaries solutions. As the region’s only dedicated real estate secondaries manager, Aquilius oversees US $2.0 billion in assets. The entire team is locally based and collectively brings decades of private markets experience in sourcing, investing and structuring secondaries transactions in Asia. Over the years, Aquilius has built a proven track record for delivering tailored solutions that address the evolving needs of both limited partners and general partners. This article presents our latest market perspective on Asia

Pacific’s real estate secondaries landscape — shaped by our on-the-ground experience and stakeholder relationships — highlighting the region’s key dynamics, opportunities and underlying structural forces.

Global secondaries: Record growth unlocked

Since Aquilius’ last publication in October 2023 (Wolff and Chow, “A generational opportunity: Investing in real estate secondaries in Asia,” Institutional Real Estate Asia Pacific), the fundamental drivers supporting the need for secondaries solutions for both LPs and GPs have intensified globally and are increasingly pronounced in Asia Pacific.

Global secondaries transactions volume reached US$102 billion in the first half of 2025, setting the stage to surpass last year’s record (Evercore). This growth reflects a decadelong surge, with annual volumes quadrupling driven by an increasing asset base, persistent liquidity pressures and structural shifts in private markets.

Asia Pacific: A highly disintermediated market

Asia Pacific remains underpenetrated in the secondaries market despite already accounting for approximately 30 percent of global private markets by assets under management (Preqin). The region contributed just 3 percent of brokered secondaries volume across all asset classes in 2024, compared with the more mature North American and European markets, where secondaries transactions are largely intermediated (Greenhill, Jefferies).

Structural barriers are hindering the growth of capital dedicated to secondaries in the Asia Pacific region. Asynchronous investment conditions and diverse regulatory environments across key markets make it difficult for traditional intermediaries and global secondaries investors to source and/or accurately underwrite multi-jurisdictional asset exposures. Most transactions in Asia continue to be originated bilaterally and off-market, requiring deep local networks across LPs and GPs to access deal flow — a process that takes years to cultivate and navigate. Building and scaling regional teams also demands significant time and investment, given the complexity of operating across multiple, highly diverse markets. These challenges pose substantial roadblocks for global secondaries firms seeking to establish a meaningful presence in the region. Consequently, international secondaries capital often engages in Asia Pacific secondaries from offshore and on an opportunistic basis, relying primarily on “desktop” underwriting due to the lack of an on-the-ground presence and limited access to real-time asset and market insights.

Against this backdrop, it is unsurprising that only 3 percent of global dry powder for real estate secondaries is dedicated to the Asia Pacific region (Preqin) — reflecting the region’s significant undercapitalisation relative to its scale and opportunity.

As LPs and GPs increasingly turn to secondaries solutions for liquidity management and strategic portfolio optimisation, many are left with unresolved liquidity needs, given limited avenues to execute their targets. Aquilius was established to help bridge this gap in the Asia Pacific real estate secondaries market. Through our dedicated flagship vehicles, we have developed a trusted reputation in providing both LP-led and GP-led solutions during the past few years.

Aquilius: Delivering innovative and tailored secondaries solutions in Asia Pacific

At Aquilius, we offer a broad suite of tailored secondaries solutions designed to unlock value and manage liquidity for both institutional investors and fund managers with underlying fund or asset positions in the Asia Pacific region. Many sellers today are motivated to transact in order to reallocate capital to newer fund vintages and to more familiar domestic markets at a time of increased market uncertainty. Our focus is on executing each transaction expediently and with certainty, typically helping sellers achieve their liquidity targets as quickly as within three months from initial engagement. As a result, sellers view Aquilius not only as a reliable source of capital, but also as a long-term strategic partner as they navigate global portfolio construction.

We have built a strong foundation in LP-led solutions, including purchase of fund and asset interests, joint venture stakes and strip sales. Our senior investment team has executed more than US$3 billion in LP-led transactions in Asia Pacific during the past two decades, predominantly on an off-market basis. Aquilius prioritises direct engagement with each seller to fully understand their unique objectives — whether financial, regulatory, tax-related and/or timing-specific. We also structure payment terms in ways that best suit the needs of the seller, which may include preferred equity, earn-out mechanisms or deferred payments. This hands-on approach enables Aquilius to create bespoke solutions that are often highly structured and designed to help sellers achieve their intended goals.

On the GP-led side, Aquilius has assembled a local team with deep direct investing expertise across the Asia Pacific market. Our investment professionals carry blue-chip backgrounds and have a long track record of investing across the key markets in the region. The local market expertise and differentiated underwriting capabilities have enabled us to work closely with regional fund managers to structure complex secondaries solutions, including continuation vehicles, tender offers, portfolio and single-asset recapitalisations and more.

“As LPs and GPs increasingly turn to secondaries solutions for liquidity management and strategic portfolio optimisation, many are left with unresolved liquidity needs, given limited avenues to execute their targets. Aquilius was established to help bridge this gap in the Asia Pacific real estate secondaries market.”

BASTIAN WOLFF

Founding Partner

Aquilius Investment Partners

Based on Aquilius’ market observation, secondaries activity in Asia Pacific remains skewed towards LP-led deals, with an estimated 70-30 split (Aquilius estimates). This contrasts with a near 50-50 global balance in 2024 and marks a notable shift from the 80-20 LP-led dominance a decade ago (Jefferies). As we look ahead to growth opportunities in the real estate secondaries market, Aquilius is actively expanding its GP-led offerings to capture this untapped potential. We are proactively engaging and educating GPs in the region on how secondaries can serve as a valuable tool for liquidity management and portfolio optimisation.

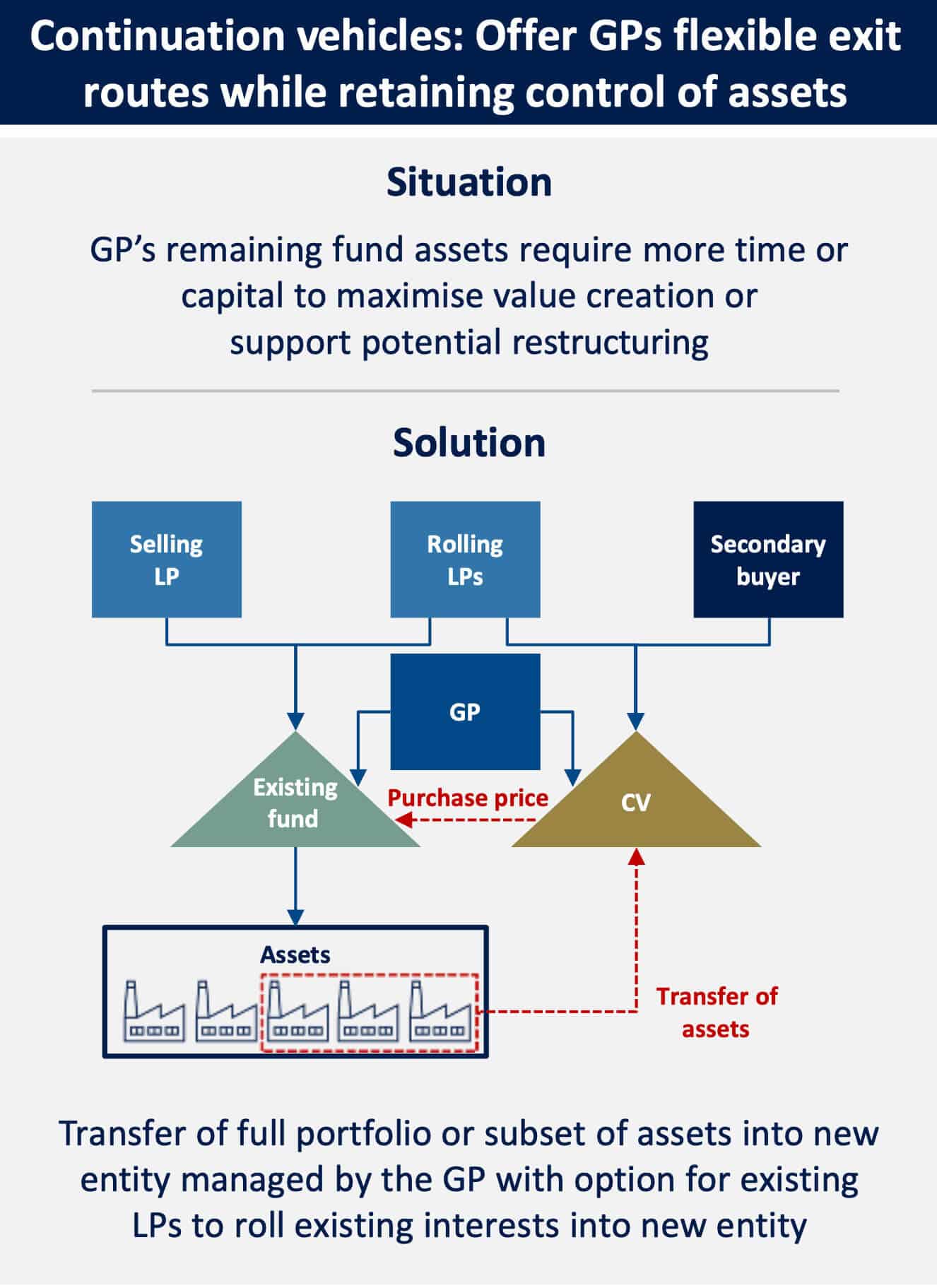

Continuation funds: A strategic tool for GPs and LPs

Amongst GP-led solutions, continuation funds are the dominant structure, accounting for more than 80 percent of total GP-led volume in 2024 (Jefferies). These vehicles offer sponsors flexible exit routes while retaining control of highquality assets and enabling further capital deployment for performance enhancement strategies. For underlying LPs, they provide liquidity in a challenging macro environment or the option to maintain exposure to strong-performing investments.

“While GP-led transactions can be multifaceted, we draw on our experience and careful navigation of governance, valuation and tax considerations — including best practices and lessons learned — to guide sponsors through the process with clarity and efficiency.”

JENNIFER HSU

Managing Director, Head of Investor Relations

Aquilius Investment Partners

As the market matures, continuation funds are increasingly viewed not just as alternatives to exits, but as core instruments in the strategic toolbox of sponsors and secondary investors alike.

Typically, Aquilius spends several months working closely with GPs before any formal commitment. During this period, we support sponsors in navigating the secondary sales process, understanding their liquidity and performance objectives, and exploring creative, fit-for-purpose transaction structures. Once engaged, execution timelines generally range from eight to 12 weeks, often exceeding those of LP-led deals due to inherent complexities, such as new-vehicle structuring, asset transfers, legal documentation, LPAC approvals and other considerations. While GP-led transactions can be multifaceted, we draw on our experience and careful navigation of governance, valuation and tax considerations — including best practices and lessons learned — to guide sponsors through the process with clarity and efficiency.

Aquilius case studies: Secondaries in action

Two investments exemplify our approach to delivering tailored liquidity solutions for LP-led and GP-led transactions: (1) a Pan-Asia diversified portfolio anchored by high-quality logistics assets, and (2) an Australian residential land-lease community.

LP-led: Pan-Asia diversified portfolio anchored by high-quality logistics assets

Aquilius partnered with a North American institutional investor seeking to divest $150 million of Asia Pacific exposure as a result of the denominator effect and needing to rebalance their private market investment portfolio. The seller’s portfolio comprised Pan-Asia fund positions with underlying assets diversified across multiple sectors and geographies but largely anchored by high-quality logistics assets located in India, Japan, Australia and South Korea.

Recognising the seller’s specific structuring requirements and tight timeline, Aquilius swiftly mobilised a solution aligned with both their strategic goals and deadline. Leveraging the depth of our investment team and long-standing relationships with the GPs managing the fund positions, we efficiently underwrote a complex portfolio comprising more than 50 assets spanning seven sectors and six countries. With a clear understanding of the seller’s limitations and our experience in structuring tailored arrangements, Aquilius designed a solution incorporating deferred payment terms and expedited the execution process — closing the transaction in just eight weeks. This thoughtful and proactive approach enabled us to deliver a highly structured outcome that met the seller’s objectives while navigating the intricacies of a multi-fund, multi-country portfolio.

GP-led: Australia residential land-lease community

Aquilius spearheaded a A$200 million (US$129 million) GP-led secondary continuation vehicle for Serenitas, Australia’s leading pure-play senior living platform, with more than 5,000 residential units across 31 communities.

Aquilius had been following Serenitas very closely since its inception in 2017 and saw an opportunity in 2024 to recapitalise a 20 percent stake in the business, alongside its founder upon an ownership change. Our capital solution not only offered liquidity to existing shareholders after their intended hold period but also provided Serenitas with additional capital to scale its operations further across Australia.

Serenitas’ underlying investment theme is particularly compelling, as our capital addresses both the domestic housing shortage and affordability issues for a large and growing demographic — seniors aged 50 and older — while offering a stable income stream for underlying investors. Residential landlease communities are gaining market share from traditional retirement villages by enabling retirees to enjoy the fulfilment of home ownership at a lower cost, without sacrificing the sense of community and social connection. As retirees transition from their homes into communities such as Serenitas, they also release housing stock back in the market for younger buyers — a shift viewed favourably by the government.

Asia Pacific secondaries: Positioned for growth

The aforementioned case studies are just two examples demonstrating how Aquilius navigates this region’s fragmented market environment to deliver institutional-quality, nimble and valuable liquidity solutions for both LPs and GPs.

We believe the need for dedicated secondaries expertise in Asia Pacific will only grow as three key dynamics continue to unfold: the normalisation of secondaries sales as part of portfolio management and pruning strategies; increased capital allocation to secondaries as a core component of portfolio diversification; and broader market education as understanding of secondaries’ flexibility and strategic value deepens.

Aquilius remains committed to continue being the leading provider of real estate secondaries solutions in the region — partnering with institutional investors and fund managers to deliver value through creative, efficient and scalable liquidity solutions, while delivering compelling returns to our own investors. With a proven track record, deep regional insights and a hands-on approach, we are well-positioned to shape the future of real estate secondaries across Asia Pacific.